We all know the frustration of unexpected setbacks. But for those living in the vise grip of poverty, a financial setback can mean more than just frustration.

It can mean the difference between eating that day, or not.

It can mean the difference between sending your children to school, or not.

It can mean the difference between hope and despair.

Today, 1 in 11 people on the planet live in extreme poverty — most of them smallholder farmers. Among them, at least half are women, many of whom have never experienced a chance to grow or diversify their incomes, and who live day-to-day on what their own small farms can produce. When setbacks occur — in the form of natural disasters, rising costs, illness, or other emergencies — the razor-thin margin they survive on can disappear overnight.

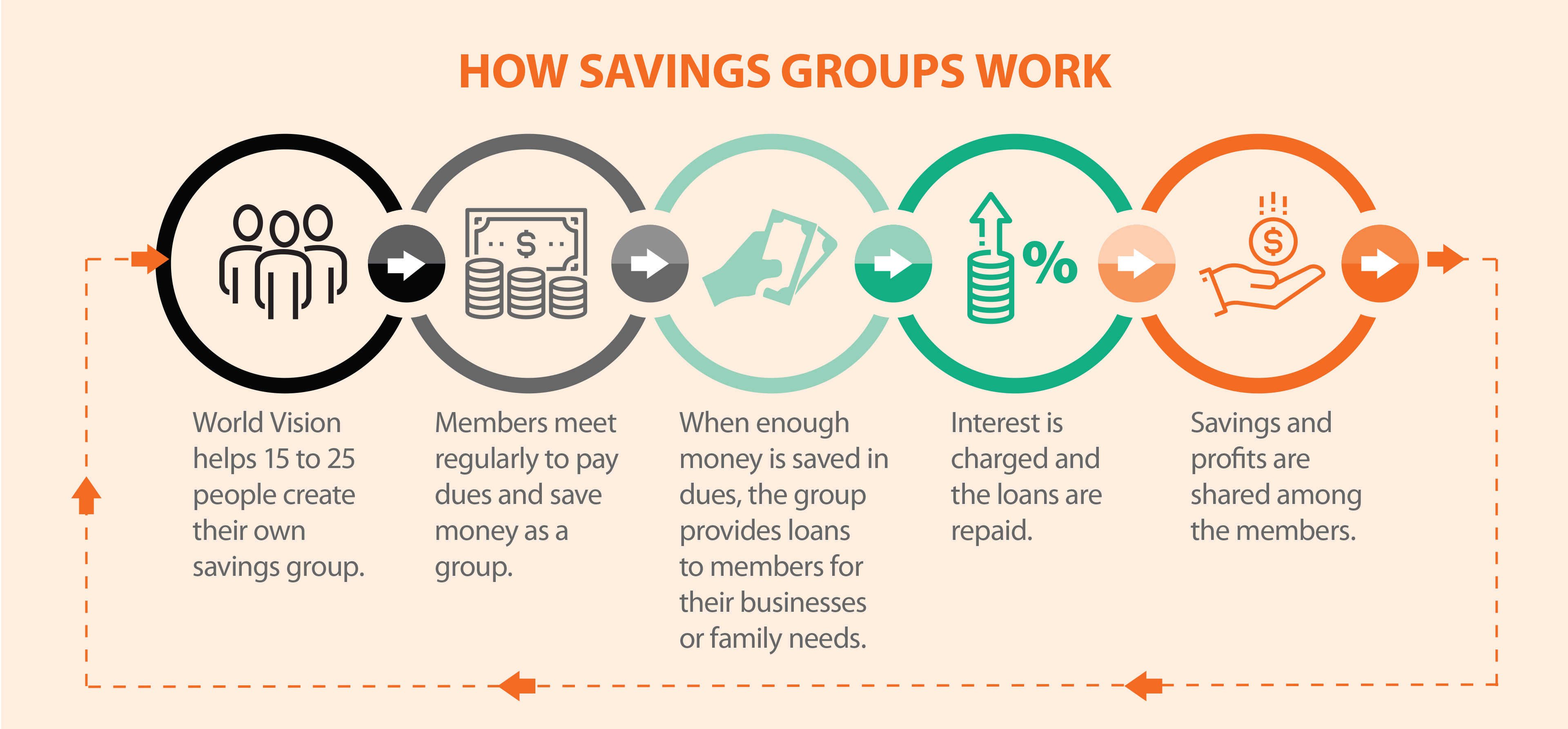

But that’s not how the story has to end. Through World Vision and the generosity of partners like you, every 60 seconds, a family gets the tools to overcome poverty. One of those tools? Savings groups, which offer women entrepreneurs a way to support each other in saving for the future and building financial resilience. When World Vision helps a community start a savings group, that includes providing the first loan to get them going. On average, a first loan of $800 is provided to a savings group that has around 22 members, 80% of whom are women!

Here’s a look at how savings groups work:

As members repay their loans plus interest, the loan fund increases, and the funds raised become a permanent asset for continuous lending to members into the future. Access to emergency funds prevents setbacks from becoming financial ruin. When new opportunities open up for members, the razor-thin margin begins to widen. Thriving is finally possible.

Meet Sarafina

Sarafina works in the store she opened with the help of a savings group loan. |

In Zambia, a mother named Sarafina struggled to earn enough to feed her children or send them to school. “My children weren’t able to eat three meals in a day,” she says. “I used to feel sad when I would see other people’s children go to school.”

Sarafina joined a savings group World Vision started in her community and was able to open her own store with the help of a loan. When thieves broke in and stole all her goods, the setback didn’t destroy her. Instead, she was able to take out another loan to restock her store and continue providing for her family.

Meet Wrebby

Wrebby’s family was able to break free from poverty, thanks to their hard work and the benefits of savings groups. |

“We could see our children going the whole day without eating,” says Wrebby, another mom in Zambia struggling to provide for her family. She and her husband were on the verge of divorce from the pressures of poverty, and they asked God to intervene.

When World Vision introduced savings groups in the area, Wrebby was one of the first to join. With funds borrowed from the group, she was able to plant a garden and begin raising chickens. Today, she and her husband sell eggs and vegetables to the community, earning enough to send their children back to school. Their experience inspired their 15-year-old son to join a youth savings group, which helps pay for school supplies. He’s even started his own business selling cell phone minutes to people in the community for additional income.

Investing even deeper

The investment in members goes deeper than livelihoods. World Vision focuses on the whole person — body, mind, and soul — by taking group members through a curriculum called Biblical Empowered Worldview. This life-changing program uses biblical principles to help people see their own value, potential, and ability to change their own lives and those of their families and communities. One of the key components of the training is to encourage people to move beyond meeting their own needs and begin looking after the most vulnerable people in their community. It’s a beautiful and poignant picture of God’s kingdom and the domino effect of generosity.

A profound impact

It’s precisely this generosity that fuels progress for people living in extreme poverty — especially women. Because our microfinance ministry has 20 years of lending history and can safely borrow from banks, your gift to the Investing in Women Fund will multiply 2.3 times in impact to help provide loans to savings groups. Please prayerfully consider empowering women start and grow successful businesses to overcome poverty — both now and for generations to come.